Search the latest and greatest job opportunities in sport

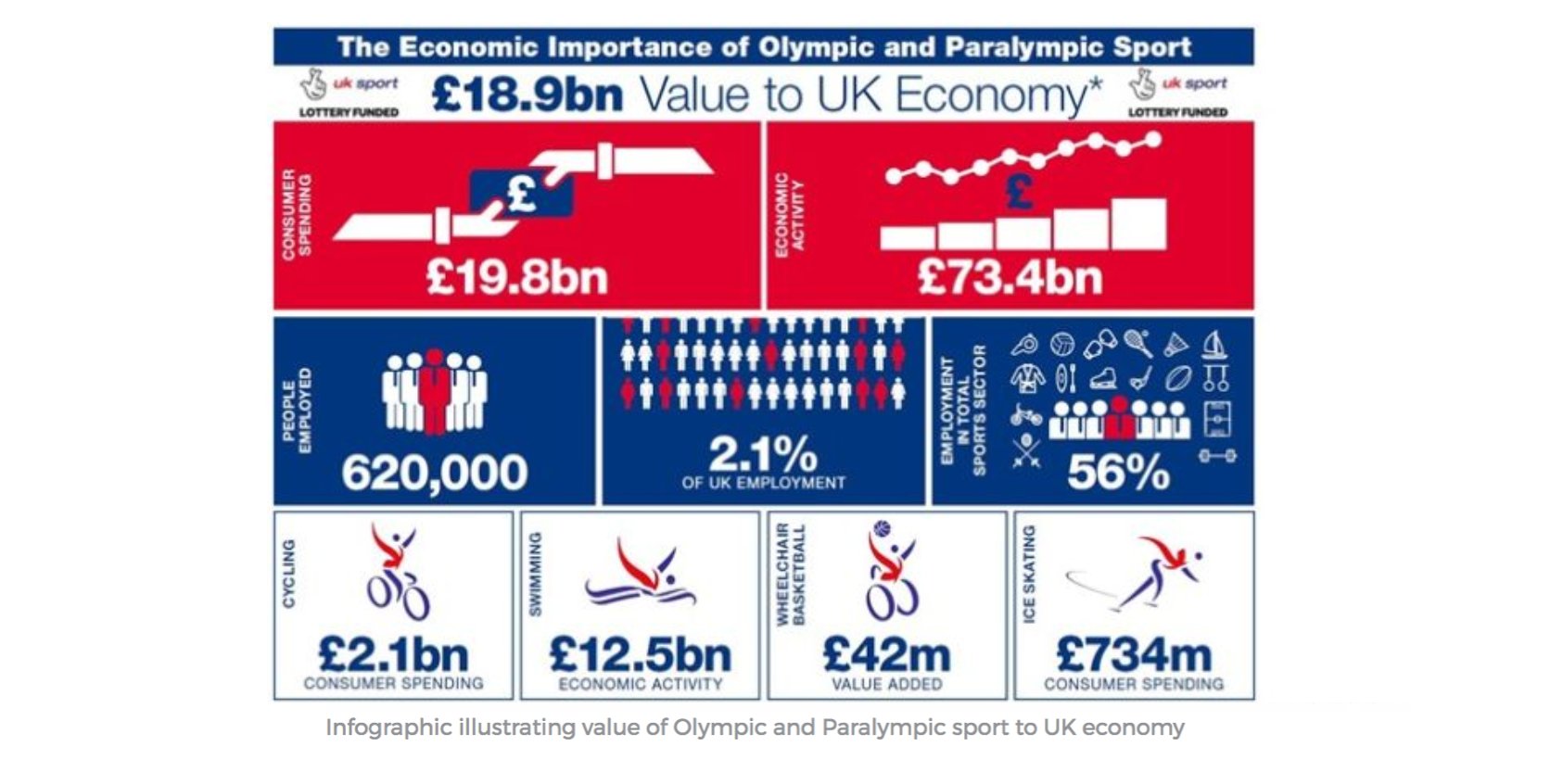

A recent report, 'The Economic Importance of Olympic and Paralympic Sport' finds that: “The Gross Value Added of Olympic and Paralympic sports in the UK was £18,900 million in 2014 with the largest single area being summer Olympic sports, generating £16,104m (85%) of this GVA. The GVA of Olympic and Paralympic sport is equivalent to 55% of the whole sport industry, as estimated by DCMS [the UK government’s Department for Digital, Culture, Media and Sport].”

A recent report, 'The Economic Importance of Olympic and Paralympic Sport' finds that: “The Gross Value Added of Olympic and Paralympic sports in the UK was £18,900 million in 2014 with the largest single area being summer Olympic sports, generating £16,104m (85%) of this GVA. The GVA of Olympic and Paralympic sport is equivalent to 55% of the whole sport industry, as estimated by DCMS [the UK government’s Department for Digital, Culture, Media and Sport].”

In the report, which was compiled on behalf of UK Sport, the national sports administration and funding body, by Sheffield Hallam University’s Sport Industry Research Centre, GVA is defined as “profits plus wages within an industry, less an adjustment for taxation and subsidies. GVA is a proxy for Gross Domestic Product (GDP), the key measure of the scale of an economy.”

Importantly, the report points out that: “The GVA is largely a function of the pattern of participation (or demand) among sports. For this reason, the sector is driven by Athletics, Swimming and Cycling. When both direct and indirect effects are taken into account, the importance of the sector increases to £29,979m.”

It is this participation element in certain Olympic sports that helps to explain why their GVA exceeds that of all other sports, including soccer (excluded from the report along with certain other Olympic sports, including golf, tennis and rugby “because the Olympic and/or Paralympic Games are not the pinnacle of achievement in these sports”).

On the other hand, the five new sports for Tokyo 2020 (baseball-softball, sport climbing, karate, skateboarding and surfing) “are included to enable like for like comparisons to be made in future updates of this study.” Other popular sports such as motor sport, snooker and cricket are excluded because they are not Olympic or Paralympic sports.

The report identifies swimming as by far the top participation sport in the UK, based on data from two national surveys: the Active People Survey and the Taking Part Survey. Based on a participation rate of at least once every four weeks for those aged 16 and above, the report finds that 13.8 per cent of adults participate in swimming, compared with 8.3 per cent in athletics and cycling (road, mountain bike, BMX and track combined) 5.43 per cent.

At the other end of the scale, Olympic sports with the lowest participation rates include those that are not generally regarded as part of the UK sporting culture such as handball (0.02 per cent), freestyle and Graeco-Roman wrestling (both 0.004 per cent) and cross-country skiing (0.01per cent).

Other measures of the value of Olympic and Paralympic sports include employment, consumer spending and turnover.

In relation to employment, the report says: “The Olympic and Paralympic sector provides employment for 623,000 people (head count). This is equivalent to 480,000 full-time equivalent employees when adjusted for part-time workers. The sector generates employment equivalent to 55.7% of all sport employment (DCMS) and 2.1% of total employment nationally…

“When the indirect effects are taken into account, the sector generates approximately one million jobs.”

Consumer spending on Olympic and Paralympic sport in the UK is put at £19.8 billion, equivalent to £306 per head of population over the year 2014 and to 1.7 per cent of overall household spending.

Meanwhile, turnover, defined as the total economic activity associated with Olympic and Paralympic sport, and also comprising direct effects such as the operation of clubs, and indirect effects, such as supply chain activity, is put at £73.4 billion. Almost half of the turnover identified is produced indirectly through the supply chain.

Between them, as the table above shows, Olympic and Paralympic sports account for more than half of the country’s sporting economy, more than 1 per cent of the entire UK economy and more than 2 per cent of all UK employment.

UK Sport said: “This level of economic activity makes Olympic and Paralympic sport larger than other whole sections of the economy, such as the water industry, or the agriculture, forestry and fishing sector. Road cycling alone is now worth £2.3bn to the UK economy, rising to £3.6bn if the supply chain is included, and supporting 75,000 jobs.

"The strength of the Paralympic sport sector is shown by a value of more than £2bn, with wheelchair basketball alone being worth £42m to the country. And with three months to go until the Olympic Games in PyeongChang, winter sport is shown to be an increasingly popular industry, with ice skating alone worth £400m in the UK.”

UK Sport said that the data suggests that British success at the Beijing 2008, London 2012 and Rio 2016 Olympic Games has helped to spark an upsurge in economic activity in sports such as running, cycling and swimming, with employment generated by Olympic and Paralympic sports now larger than the entire sports sector was in 2004.

The report uses official National Accounts to measure the sector’s contribution to various industries and takes into account public participation in sport “as well as the Government and Lottery-funded elite end of Olympic and Paralympic sport.”

The report concludes: “Olympic and Paralympic sports are fundamental in creating GVA and employment within the overall sport industry, accounting for the majority of the output produced. Their contribution to employment at 2.1% is much higher than their contribution to GVA, implying that growth in Olympic and Paralympic sports will result in an accelerated rate of growth in employment.”

Katherine Grainger, chair of UK Sport, said: “This report for the first time shows the huge value of Olympic and Paralympic sport to the wider economy in terms of jobs and consumer spending. We know that our Great British medals in recent and future years can help to inspire the nation to get active and take up sports and exercise, whether in a local parkrun or aiming for an Olympic podium. That’s why investing in our medal success through the National Lottery is also investing in the health and wealth of the country as a whole.”

Download the full report here.

This article was written by Callum Murray and originally published by our partners SportCal .

Search the latest and greatest job opportunities in sport

In the world of professional sports, sponsorship represents a significant source of revenue and plays a vital role for t...

Read moreThe sports industry is a vibrant and multifaceted industry, made up of a diverse range of sectors that shape its global ...

Read morePablo Romero, director of protocol at Sevilla FC and lecturer in the UCAM Master's Degree in Sports Management, shares t...

Read more