Search the latest and greatest job opportunities in sport

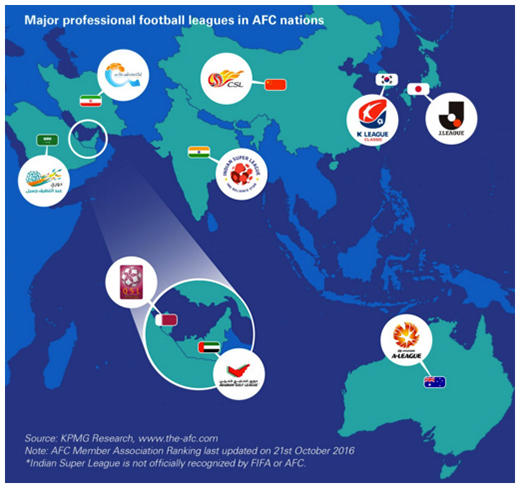

Paul Nicholson of Inside World Football examines the major efforts that Asian Football Confederation (AFC) nations have made with their professional leagues to narrow the gap with their Western counterparts. A new analysis by Football Benchmark, the sports data and analysis arm of KPMG, finds that it's not a case of if but “when and which of its (Asia’s) leagues will be able to compete and eventually challenge the game’s traditional superpowers in the long term.”

Football Benchmark finds that the leading professional Asian leagues are growing in interest and value, though there is a variety of models and different challenges facing each.

The researchers point out that the professional league environment in Asia is very diverse. “Against a backdrop that includes developing economies, economic volatility and additional competition from European leagues and other sports, the challenges are manifold for clubs, leagues and investors.

“Moreover, as a result of the limitations on the number of foreign players that clubs can field, the ability to develop domestic talent will be a determinant factor in the long-term success of these young competitions; which still need to find sustainable models to maintain and increase the current level of interest.”

The highest impact breakthrough league in Asia is in China, the country that is investing the heaviest in football clubs and associated football businesses and sponsorship worldwide. The international focus, has “renewed stakeholder confidence in local competition”, says the report.

The Chinese Super League (CSL) recently sold its domestic broadcasting rights for RMB 8bn in a five-year agreement (€213 million per season), the largest of its kind among Asian leagues. Although the league is still developing a sustainable business model, investment in foreign players and the growing interest of local fans have boosted average attendances in the 2016 season to more than 24,000 milestone – the highest in Asia.

The rise of the CSL has eclipsed Japan’s J. League, though with the introduction in 2013 of a third-tier for its professional football structure, Japan is still the benchmark for Asian competitions in terms of professionalism and long-term planning.

Europe has tempted young Japanese talent and the impact on the J-League has been a stagnation in attendances to an average 18,000 per match, and an average squad value of €12.7 million, compared to China’s €20.4 million.

The J. League is also set to benefit from a new 10-year broadcasting contract worth a reported JPY 210bn with broadcast distribution agency Perform Group – €183 million per season.

In contrast South Korea’s K-League has catch up to play with broadcasters and sponsors and has an average club squad value of €9.8 million.

Looking at central and western Asia, the Football Benchmark researchers note the passionate support underpinning the leagues but question whether the Qatar Stars League and the United Arab Emirates League have populations that can sustain the leagues competitively. Both leagues have a similar average market value of € 9.4 million and €9.1 million respectively.

“Although average league attendances are usually below the 10,000 mark, impressive crowds have been recorded for local derbies, such as the games between Saudi’s Al Ahli and Al-Ittihad (above 60,000) and Iran’s Persepolis FC versus Esteghlal FC (100,000),” says the report

In contrast the authors highlight the Saudi professional league which is in the process of privatising its clubs (average squad market value €5.7million), and in 2014 signed a 10-year deal with the Dubai-based MBC group reportedly valuing the competition’s broadcasting rights at SAR 410m per season (€100 million). “With a slightly higher average squad value and a large pool of potential fans (population 79.1 million), the Iranian Gulf Pro League (average squad market value €6.5 million) also has the potential to attract significant revenues, currently hampered by the lack of a competitive broadcasting market,” says the report.

Looking at closed league models (franchised teams with no relegation), the report says the Australian A League and India’s ISL are working.

The ISL’s broadcaster, one of the league organisers, has played a key role in maximising the media reach of a competition which in its 2015 edition reached average attendances above 26,000. The authors point out that this is higher than both Serie A and Ligue 1 and the ISL it still only at a fledgling stage with expansion and integration into the Indian football structure to come.

This article was originally published by Inside World Football

Give your career in sport a boost with the latest live vacancies , or create an account today and stay up to date with all the latest industry knowledge, events and jobs in sport.

Search the latest and greatest job opportunities in sport